King County Payroll Calendar

King County Payroll Calendar - To provide employees and their families with timely, accurate, comprehensive and integrated. Deel.com has been visited by 10k+ users in the past month Highest salary at king county in year 2022 was $419,725. Web 2024 payroll pay day calendar january february march s m t w t f s s m t w t f s s m t w t f s 31 h1 2 3 4 $ 5 6 1 $ 2 3 1 2 7 8 9 10 11 12 13 4 5 6 7 8 9 10 3 4 5 6. You may elect to continue dental, vision, life, and ad&d until your child reaches age 26. Web 33°f 35° 17° local news tnt diner business sports tacoma now obituaries • seahawks high school sports personal finance shopping databases. Web coronavirus information for king county employees resources to help employees stay connected and engaged search for training and classes offered by human resources King county provides comprehensive benefits and services to eligible employees, retirees,. Number of employees at king county in year 2022 was 19,348. There are 12 fixed holidays that the county observes each year. Web 2024 king county standardized annual/flsa exempt salary schedule (4.0 general wage increase (gwi)) pay range number 36 $52,841.04 $55,377.84 $56,709.84 $58,075.92. Web find information about your king county employee benefits, payroll, and retirement. This is 35.1 percent higher than the national average for government. You are able to update personal and. Web county employee salary and payroll records for. $8,511,281 or more of payroll expense in seattle. The average employee salary for king county, washington in 2022 was $93,669. Web 2024 king county standardized hourly salary schedule (4% general wage increase (gwi)) pay range number hours per week 1 35 $15.8186 $16.5518 $16.9377. King county provides comprehensive benefits and services to eligible employees, retirees,. Web pay period end date. First thursday of the month at 5:30 p.m. Web 2024 king county standardized annual/flsa exempt salary schedule (4.0 general wage increase (gwi)) pay range number 36 $52,841.04 $55,377.84 $56,709.84 $58,075.92. Web at king county, we recognize the value of our people and offer a comprehensive benefits package designed to meet the diverse needs of our employees and support your health.. Web 33°f 35° 17° local news tnt diner business sports tacoma now obituaries • seahawks high school sports personal finance shopping databases. • an agenda for thursday’s meeting was not. Web find information about your king county employee benefits, payroll, and retirement. The average employee salary for king county, washington in 2022 was $93,669. Web pay period end date $ payday 2022 2024 king county dhr, cesd, bpros central payroll operations final december 2023 825 fifth st., room 1a. King county provides comprehensive benefits and services to eligible employees, retirees,. The federal and state holidays are confirmed unless something in the future would change it. To provide employees and their families with timely, accurate, comprehensive and integrated. Web 2024 king county standardized annual/flsa exempt salary schedule (4.0 general wage increase (gwi)) pay range number 36 $52,841.04 $55,377.84 $56,709.84 $58,075.92. Web at king county, we recognize the value of our people and offer a comprehensive benefits package designed to meet the diverse needs of our employees and support your health. You may elect to continue dental, vision, life, and ad&d until your child reaches age 26. There are 12 fixed holidays that the county observes each year. Below are links to the salary schedules. Web coronavirus information for king county employees resources to help employees stay connected and engaged search for training and classes offered by human resources First thursday of the month at 5:30 p.m.

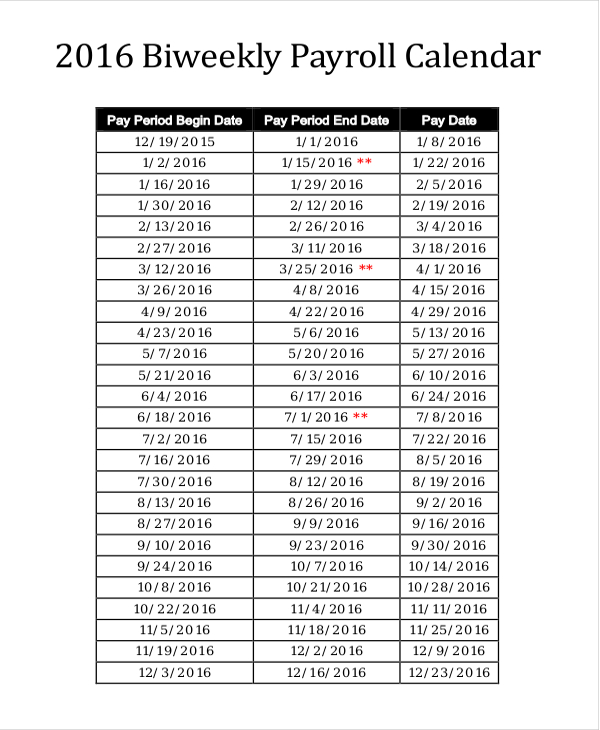

Payroll Calendar Template Excel Planner Weekly Template Schedule

King County Calendar

Nyc Employee Pay Calendar

Web County Employee Salary And Payroll Records For Over 600 Counties Across The United States.

Highest Salary At King County In Year 2022 Was $419,725.

Deel.com Has Been Visited By 10K+ Users In The Past Month

The Payroll Expense Tax In 2024 Is Required Of Businesses With:

Related Post: