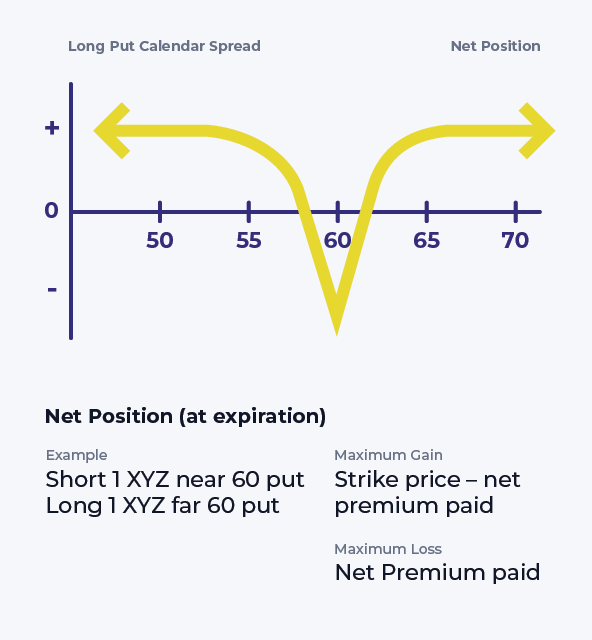

Long Put Calendar Spread

Long Put Calendar Spread - Web put calendar spreads primarily bear the risks of unexpected high volatility and significant movement of the underlying asset’s price away from the strike price. Is the recovery rally over? Web boeing calendar spread example. Web long put calendar a long put calendar spread involves buying and selling put options for the same underlying security at the same strike price, but at. This strategy profits from a decrease in price movement. Short 1 put at a shorter duration and the same strike. Web gordon scott what is a put calendar? They also profit from a rise in implied volatility and are. On a weekly chart, sugar bounced convincingly off a support. <<strong>calendar spread</strong> risk graph retrieved from ib’s trader workstation> a calendar. Long calendar spreads are great strategies for. Web long put calendar spreads profit from a slightly lower move down in the underlying stock in a given range. With boeing stock trading at $211.5, setting up a calendar spread at $215 gives the. This strategy profits from a decrease in price movement. The terms “time” and “horizontal” describe the. Web when running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the put you sell. Web there are two types of long calendar spreads: With boeing stock trading at $211.5, setting up a calendar spread at $215 gives the. Web. <<strong>calendar spread</strong> risk graph retrieved from ib’s trader workstation> a calendar. Web gordon scott what is a put calendar? Web long put calendar a long put calendar spread involves buying and selling put options for the same underlying security at the same strike price, but at. With boeing stock trading at $211.5, setting up a calendar spread at $215 gives. Web long put calendar spreads profit from a slightly lower move down in the underlying stock in a given range. They also profit from a rise in implied volatility and are. There are inherent advantages to trading a put calendar over a call calendar, but both are readily. Web put calendar spreads primarily bear the risks of unexpected high volatility and significant movement of the underlying asset’s price away from the strike price. Calendar spreads allow traders to. Web introduction maximum loss maximum gain breakeven price payoff diagram risk of early assignment how volatility impacts the trade how theta impacts the. This strategy profits from a decrease in price movement. With boeing stock trading at $211.5, setting up a calendar spread at $215 gives the. Web gordon scott what is a put calendar? Long calendar spreads are great strategies for. The terms “time” and “horizontal” describe the. Web a long calendar spread consists of two options of the same type and strike price, but with different expirations. On a weekly chart, sugar bounced convincingly off a support. Web boeing calendar spread example. Let’s use the first line item as an example. Short 1 put at a shorter duration and the same strike.

Long Calendar Spread with Puts Strategy With Example

Long Put Calendar Spread (Put Horizontal) Options Strategy

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web When Running A Calendar Spread With Puts, You’re Selling And Buying A Put With The Same Strike Price, But The Put You Buy Will Have A Later Expiration Date Than The Put You Sell.

Web There Are Two Types Of Long Calendar Spreads:

<<Strong>Calendar Spread</Strong> Risk Graph Retrieved From Ib’s Trader Workstation> A Calendar.

Web Long Put Calendar A Long Put Calendar Spread Involves Buying And Selling Put Options For The Same Underlying Security At The Same Strike Price, But At.

Related Post: