Payroll Checklist Template

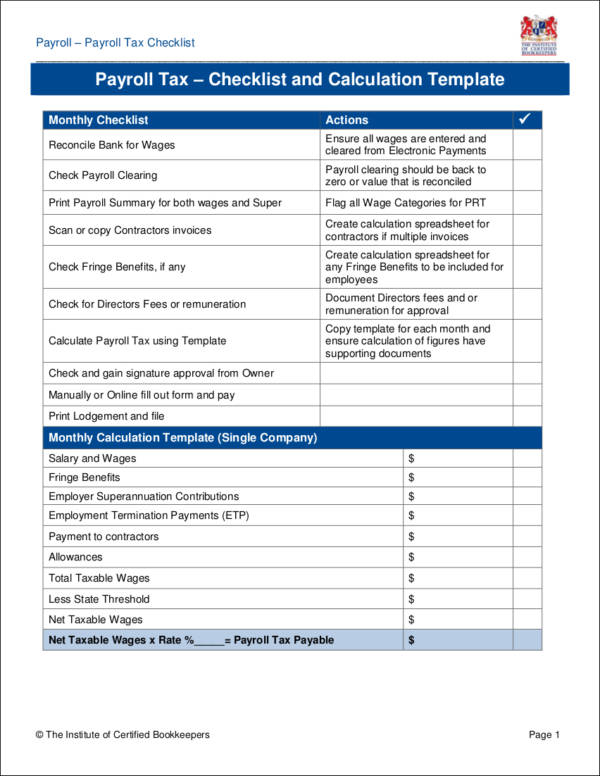

Payroll Checklist Template - Web the payroll processing checklist is a comprehensive document used by companies to ensure that all the necessary steps are taken to process employee payroll accurately and efficiently. Calculate gross wages time tracking is crucial to the process of calculating gross wages. Accurate payroll processing is necessary for employee compensation, taxation, and statutory compliances. Download the template or create an account with financial cents to access the template Information of employee payroll template; Just customize the fields to match your company’s needs and create a clear, easy to follow guide! Web to use our payroll checklist template, simply: Payroll non exempt and hourly checklist download now; January 3, 2022 last updated: The next step in the payroll processing checklist is to calculate the amount of money you need to take out of each employee’s pay; Payroll processing has multiple steps and complex calculations. Web payroll shouldn’t be a painstaking process. You can also customize it to fit your firm’s needs and share it. Just customize the fields to match your company’s needs and create a clear, easy to follow guide! It is designed to capture all information regarding the work management system. January 3, 2022 last updated: Accurate payroll processing is necessary for employee compensation, taxation, and statutory compliances. Download the template or create an account with financial cents to access the template However, payroll is a complicated process. Web the payroll processing checklist is a comprehensive document used by companies to ensure that all the necessary steps are taken to process. When you find a payroll service provider who can handle all of your needs, you may have more time. Accurate payroll processing is necessary for employee compensation, taxation, and statutory compliances. Payroll non exempt and hourly checklist download now; Web adp’s payroll checklist provides a guide to all of the latest payroll software capabilities, which you can use to evaluate. Year end employee payroll checklist download now; Written & researched by davina ward senior staff writer last updated on november 17, 2023 reviewed by chelsea krause lead staff writer Payroll clearance checklist download now; How to do payroll like a pro However, payroll is a complicated process. You can also customize it to fit your firm’s needs and. Download the small business guide to payroll. Just customize the fields to match your company’s needs and create a clear, easy to follow guide! Web our year end payroll checklist template will help you create a standardized, efficient, and quick workflow process to quickly and efficiently complete payroll for your clients’ employees. Customize a free payroll processing checklist. Employee payroll time sheet template; It is designed to capture all information regarding the work management system. Information of employee payroll template; Web review your taxes and deductions for reasonableness and accuracy—for example, if your employee is living in massachusetts, make sure they’re not being taxed in california. Web with the variety of payroll templates accessible, a payroll checklist is one of the few tools you can use to its full potential. Fields are included for an employee id number and check number for reference and easy tracking.

47+ SAMPLE Payroll Checklists in PDF MS Word Excel

FREE 31+ Payroll Samples & Templates in MS Word MS Excel Pages

Payroll Checklist Template Download from Vitalics

Web Our Weekly Payroll Processing Checklist Template Will Help You Create A Standardized, Efficient, And Quick Workflow Process To Quickly And Efficiently Complete Payroll For Your Clients.

Before Your Last Payroll Of The Calendar Year After Your Last Payroll, But Before The First Payroll Of The New Calendar Year Before Your Last Payroll Of The Calendar Year

It Includes Tasks Such As Verifying Employee Information, Calculating Pay, Tracking Hours Worked, And Deducting Taxes And Benefits.

Web To Use Our Payroll Checklist Template, Simply:

Related Post: